What is Compulsorily Acquired Land?

If you own a piece of land or house, but due to the government’s intention to development that area by compulsorily acquiring your land or house, you may be paid with a compensation sum by the government.

However, the question is whether that sum of monies you receive from the government as compensation has to pay tax?

The position of the law as decided in the latest Federal Court Case of Wiramuda (M) Sdn Bhd v Ketua Pengarah Hasil Dalam Negeri [2023] 4 MLJ 753 is very clear.

If government take away your land or house (property), and you are being compensated with a sum of monies, that sum of monies cannot be taxed by the government’s income tax arm.

If you are being tax again after 31.05.2023, you can file for judicial review to quash the decision of the tax authority or if the tax authority has taxed you for the compensation sum, you can file a judicial review to seek the tax authority to refund the sum to you.

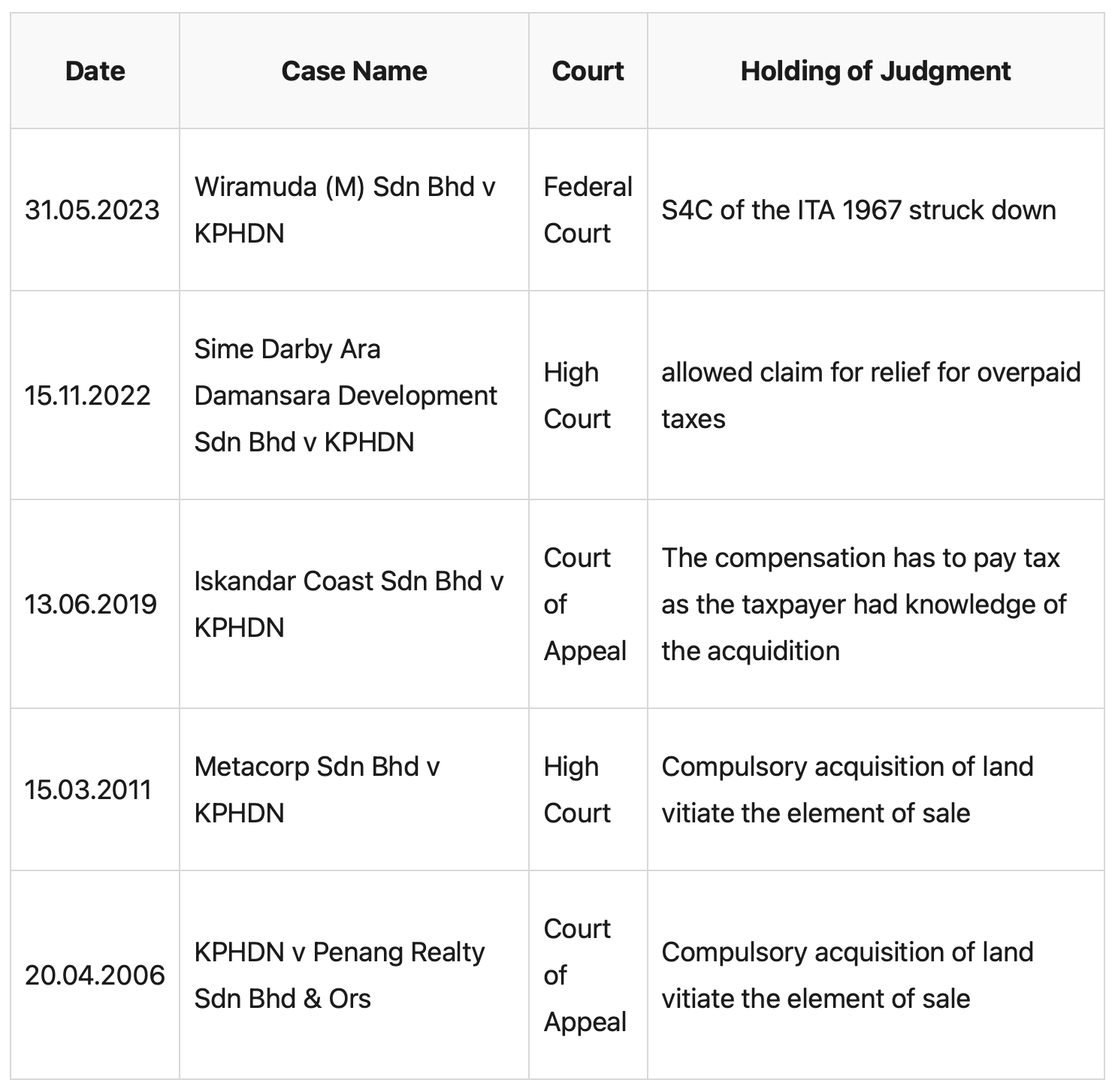

For purpose of understanding tax treatment on compulsory acquisition of land by the Government, we will look at the following latest tax cases as follow

Table 1.0: Tax treatment on compulsory acquisition of land by the Government.

Federal Court decided that Compensation received should not be taxed

Case: Wiramuda (M) Sdn Bhd v KPHDN (2023) [Federal Court]

Court: Federal Court

Date: 31.05.2023

The case went all the way to the Federal Court as the taxpayer company was asked to pay RM52,966,517.27 in taxes for the compensation sum received. The tax revenue lawyer relied on section 4C and 24(1)(aa) of the Income Tax 1967 to tax on the compensation sum received by the taxpayer company.

The question of law for the federal court to answer is whether section 4C of the ITA contravene with Article 13(2) of the Federal Constitution.

The taxpayer’s counsel argued that section 4C and 24(1)(aa) of the ITA take away the adequate compensation of the taxpayer as protected under section 13(2) of the Federal Constitution.

Here is what the Federal Court had said:

“It was an established principle of law that the adequate compensation placed the landowner in the original position as if the land had not been acquired, by referring to the market value of the land. Section 4C of the ITA considered compensation from compulsory acquisition to be a form of profit or gain and was therefore fundamentally flawed in providing that a business’s profits or gains included compensation from compulsory acquisition, as an adequate compensation had no element of profit or gain, nor any pecuniary advantage. As such, s 4C of the ITA infringed on the landowner’s right to adequate compensation under art 13(2) of the FC. “

How you can claim back the overpaid taxes for Compensation sum received before the Federal Court of WiraMuda

Taxpayer company can apply for relief with the Lembaga Hasil Dalam Negeri for the refund of overpaid taxes paid due to the striking down of section 4C of the Income Tax Act 1967. Taxpayer Company needs to act fast as the application to claim for overpaid taxes can take time to process due to large sum of compensation monies involved.

Contact Us

Email us: admin@dylanchong.com

if you would like to appeal for the recovery of the taxes paid for the compensation sum you received under the land compulsorily acquired by the government.

About the Author | Lawyer Dylan

Lawyer Dylan ( Dylan Chong 张赋翔律师 )

Tax Lawyer | Advocate & Solicitor

Bachelor of Law (LLB), University of Malaya

Dylan is the founder of Dylan Chong & Co based in Kelana Square, Petaling Jaya, Selangor. He works with Associate Professor Dr. Choong Kwai Fatt on tax appeal cases and strategize tax planning for his clienteles.

Dylan is the co-author for Practical Guide on Civil Procedure (2019) with tax expert Associate Professor Dr. Choong Kwai Fatt. He had also assisted with the research on the All Malaysian Tax Cases (AMTC) publication by Sweet & Maxwell.

Dylan graduated from the University of Malaya with a LLB Degree and was called to the Malaysian Bar. He is a member of the Legal Profession Committee of the Malaysian Bar Council since 2019.

Dylan has represented clients in various tax appeals with Custom Appeal Tribunal and also Special Commissioners of Income Tax on GST disputes, defending tax summary judgment, expenditure deduction on Section 33 of the Income Tax Act 1967 (“ITA 1967”) for construction companies, and also tax evasion under Section 140 of ITA 1967 for directors. He has also assisted large sized audit companies to convert from Partnership to Limited Liability Partnership.