What is Tax Audit?

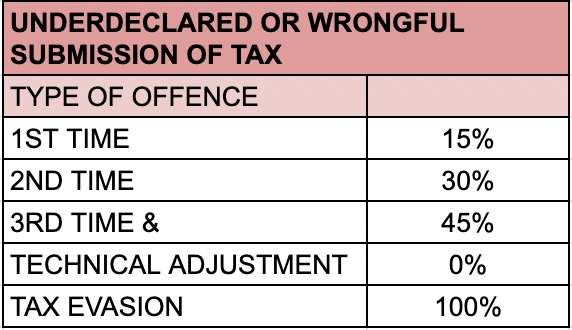

Tax Audit is the process of verification of your business record by the tax authority to ensure that there is the submission of tax is not under declared or wrongly declared.

Taxpayer (individual or company) usually are being taxed under the following section:

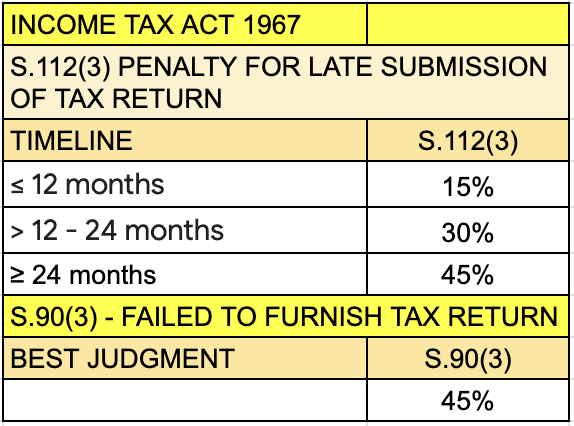

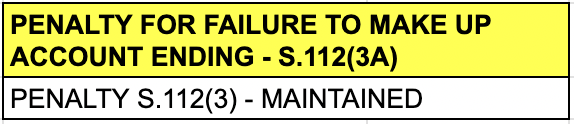

(1) section 112 - for failure to submit tax return;

(2) section 113 - for under declared their taxes; and

(3) section 114 - wilful declare their taxes / tax evasion

If the taxpayer is charged under section 114, the taxpayer (individual or company) can be charged in the Court for me criminal tax evasion.

What should you do when you receive a tax notice from LHDN?

You can either engage a tax lawyer to negotiate with the tax authority for your tax audit. tax lawyer will be able to negotiate on your behalf the tax position that can justify your tax position.

Further, tax lawyer can negotiate for reduce in tax penalty if you comply with the payment terms proposed by LHDN.

How long do i have before i have to pay the tax assessed by LHDN?

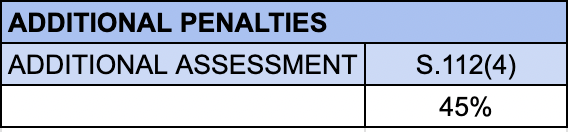

You have 30 days to either pay the tax or risk to be issued with another notice of additional assessment where you will be taxed for a second layer of penalty. The tax system in Malaysia is "pay first argue later". So you need to negotiate with the tax authority within the 30 days for the final sum of tax to be paid, or risk being issued additional penalties on your taxes.

What if i disagree with the tax assessed by LHDN?

If you disagree with the tax assessed by LHDN, you have two options:

(1) appeal - to file appeal form (Form Q) to the Special Commissioner of Income Tax ; or

(2) file judicial review - to review the decision of LHDN that did not follow the decided case law

What if the tax sum assessed is too huge?

You may consider to file for a stay order from the High Court if you can prove that the payment of tax can prejudice the cash flow of your company or create a financial crises. However, this application is not guarantee to be granted by the Court as the Court only grants if your matter falls under the special circumstances.

Contact Us

Email us: admin@dylanchong.com

if you would like to negotiate or appeal for the tax assessed within 30 days, otherwise you need to file for a Form Q to the Special Commissioner of Income Tax.

In special circumstance case, you will need to file a judicial review over the tax matter if the tax authority did not follow the decision of the Court on decided tax issues.