Case Studies

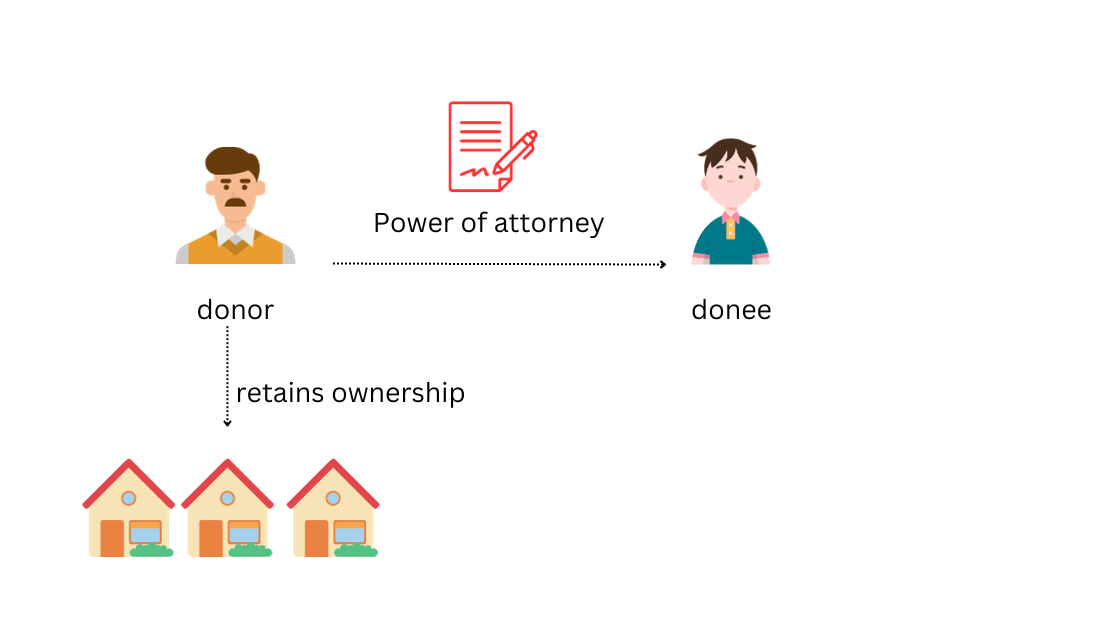

The diagram 1 above shows that the father (donor) who gives power to the son (donee) in related to the property matter. The donee can then collect rental income for the father's properties.

Here, the father retains the ownership of the property. The donee act under the instruction of the father or specified instruction under the Power of Attorney.

What is a Power of Attorney ("PA")?

A Power of Attorney ("PA") is where you (Donor) appoints another person as Donee to formally act for you.

For example, you (donor) appoints your son (donee) to manage your property and to collect rental income on your behalf. You maintain your ownership over the property.

This method is suitable for those family that wishes to reserve ownership and at the same time planning to let go of their property to their loved one over a period of time.

It is more like an agency role whereby the donee act as agent to the principal donor.

History of Power of Attorney in Malaysia

In West Malaysia (Peninsular Malaysia) , exclude Sabah and Sarawak, the law applicable for the Power of Attorney is the Powers of Attorney Act 1949 (Act 424) ["PA 1949"].

Under section 1 (2) of the PA 1949, it states that PA 1949 Act is only applicable to the States of West Malaysia.

How do we apply PA in our life (Individual)?

Individual

sell and buy property - you can appoint a donee to sell property for you, ie, to sell property (to sign sale and purchase agreement), to sign perfection of title documents; memorandum of transfer, booking form, deed of assignment and etc

collect rental income - appoint son (donee) to collect rental income from the properties you owned

withdraw monies from bank - appoint children/wife to withdraw monies from bank, open or close bank account. Due to banking secrecy, the bank is very reluctant to allow even close family member to touch the bank account holder unless there is a proper PA in place

nominate insurance proceed - to nominate your son to be a nominee via a PA

Company

developer company - the land owner create a PA to grant power to the developer to develope the land they own. the land owner then get its share of property units from the developed piece of land.

director/company representative - the company can create a PA to grant right to their employee to do certain matter, ie, to deal with banking accounts. The PA is limited to that purpose only.

What if I started to lose memory?

You can do a Power Lasting of Attorney or in Malaysia we call "irrevocable Power of Attorney".

When you lose your mental capacity, your donee (family member) is given the authority under the PA to make decision on your personal welfare, property and financial matters.

What is the criteria to make a PA?

The Donor must be:

sound mind

reached the age of 18 years old

signing the PA on free will (no coercion)

capacity to sign (ie, administrator that has yet to obtain a PA, cannot power authorise a donee, unless the letters of administration is obtained)

Differences between a revocable and irrevocable PA

A PA can be granted for a short period of term. It is important to check whether the donor wishes to have the PA to last forever or for a short period of time.

Revocable PA - a revocable PA can be revoked anytime. If the donor found out that the donee is breaching his obligation under the PA, the donor can then revoke the PA with the inclusion of the revocable PA clause.

Irrevocable PA - for an irrevocable PA, the PA lasts even after the death of the Donor. The Irrevocable PA can only be revoked if both donor and donee agree to revoke the PA.

How can a PA be revoked?

A PA can be revoked if :

- donee or donor dies;

- donee becomes unsound mind;

- donee becomes bankrupt (once bankrupt, the assets of donee goes to the insolvency department)

In practice, a PA is revoked by filing into Court a Deed of Revocation. The PA must be signed by the Donor. If the donee renounces rights over a PA, the instrument to be filed into Court is a Deed of Renunciation.

It is done through the e-filing system (EFS) of the High Court.

FAQ

We get instruction from Client on whether it is done for individual or Company. Then whether the client wants to do a specific PA or general PA.

A general PA is like "A is authorised to manage the property, monetary and welfare of B"

A Specific PA is "A is authorised to collect rental income for property H.S(D) 116557, and the income shall be transferred to Bank Acc No. 123-456-7890.

Both are different in nature.

A PA should be stamped before it is registered at the High Court. A stamping of nominal fee or RM10 will be imposed per copies.

A PA will be registered before the High Court for a PA number. It is then registered before the relevant land office, if the donee wishes to do any land transaction with the relevant land office.

A valid PA has to comply with the PA 1949 and to be duly attested by a solicitor, Judge, Magistrate, High Consular or Commissioner of Oath.

The attestation by non of the above shall renders the PA to be invalid.

If the Donor has fix a date under the PA, the PA shall expire upon that date.

Ie, the donee shall be power authorised to carry out XXX within 3 years from the date of this Agreement

By the end of that 3 years, the PA shall expire of itself.

It is propose either both donor and donee enter into a new PA, or to substitute the PA.

You can appoint a trustee to hold property, car, shares, monies, insurance policies, cash, fine art, jewellery and the list is not exhaustive

There needs to be proper planning on trust monies so that the fund does not run out. Otherwise it will defeats the purpose of forming a trust at the first place.