What is Grant of Probate ["GOP"]?

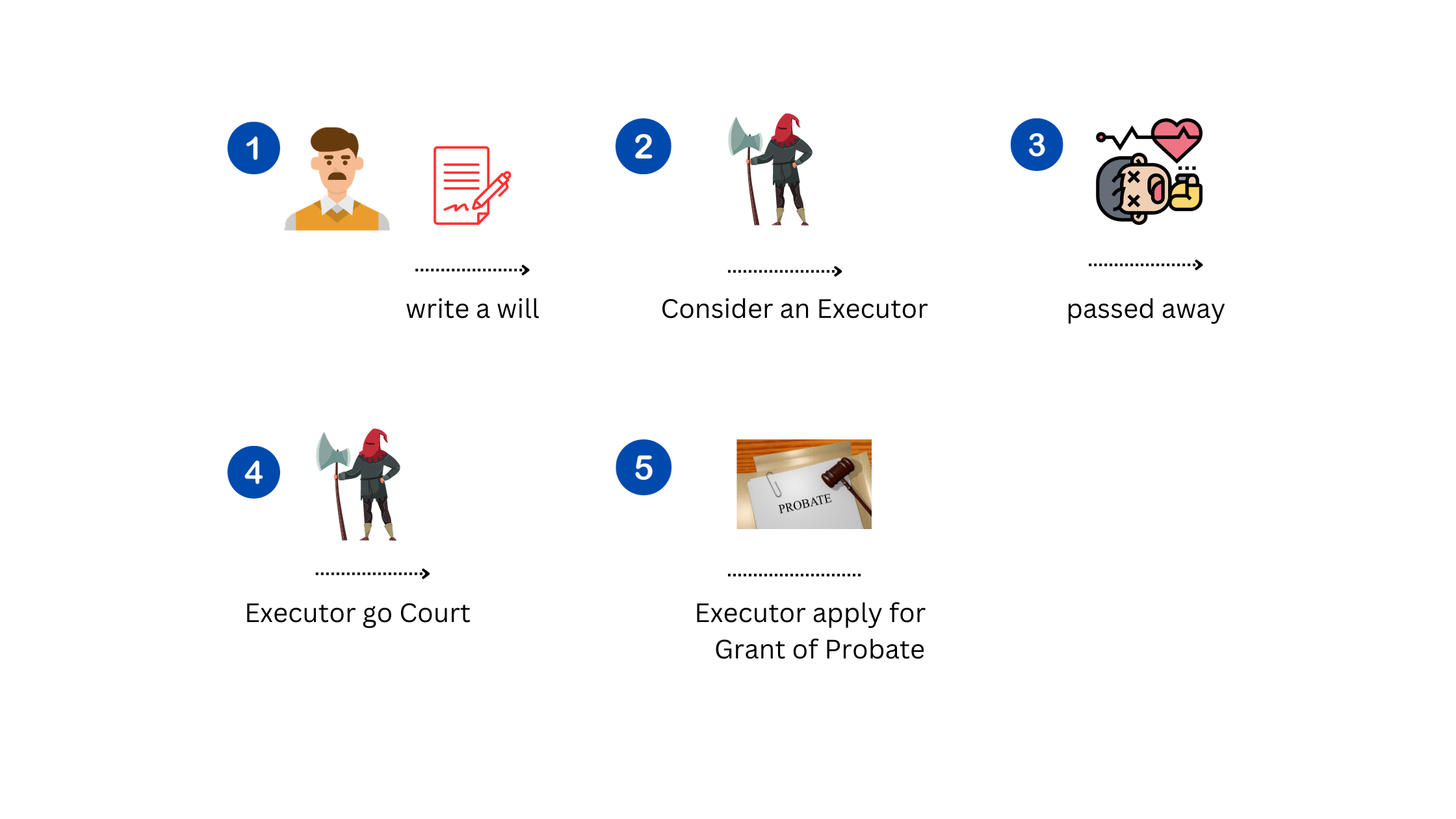

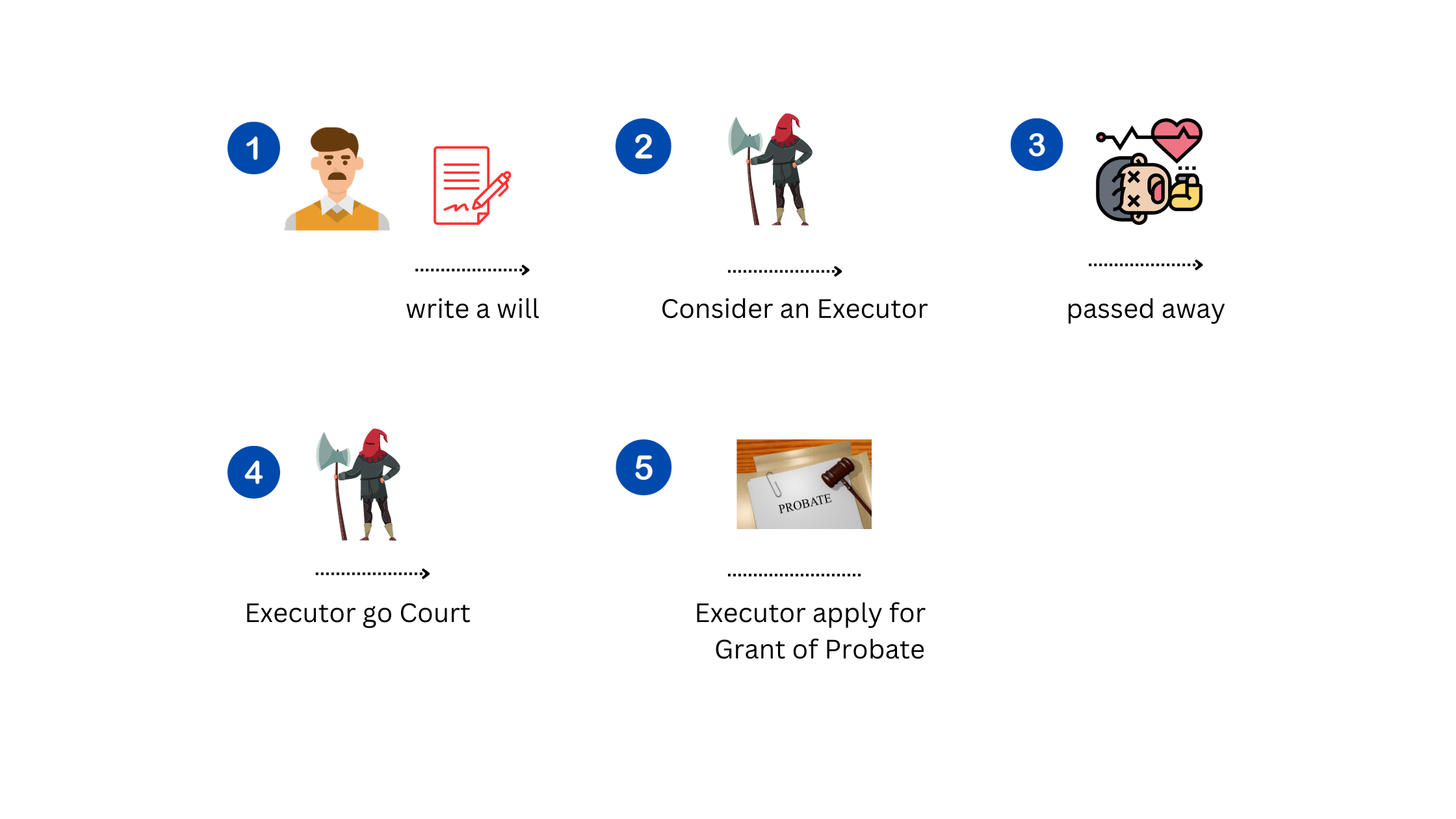

When you passed away with a Will, your situation is known as testacy. This means you have your last wishes recorded inside your will.

However this is does not means that your assets automatically transfer to your family.

Your family member cannot just show up to your bank and ask the bank to deposit your savings into their bank account.

The bank wants to see a piece of legal document call "Grant of Probate".

The Grant of Probate will appoints an executor according to the will of the deceased/testator, and the executor will represent the deceased to withdraw the monies from the bank.

In short, the executor is also the personal representative of the deceased given power by the High Court to execute the last wishes of the death.

What if I do not have a will?

If you die without a will, which is very common in Malaysia, over 80% of the Malaysian does not have a Will. This means that after they passed away, their assets either have to frozen by the government and to be distributed under the Distribution Act 1958 (Act 300).

Those who passed away without a will, their family member or beneficiary has to apply for a letters of administration.

(see https://themalaysianreserve.com/2022/09/01/over-80-of-malaysians-do-not-have-valid-will/)

Who should I consider as an Executor?

An executor has to be someone who is willing to perform the executor's role, and is able to perform the role. You do not want to appoint an executor who is staying overseas, and when you have passed away, the executor would not be able to execute the role.

An executor's job is not easy. An executor has to perform the following role:

(a) settle the deceased income taxes;

(b) to locate the deceased's will;

(c) make funeral arrangements;

(d) to deal with banks, EPF, PERKESO, Income Tax department, unclaimed money department and etc;

(e) to apply for Grant of Probate with the High Court or to re-seal the Grant of Probate;

(f) to pay all the other remaining debt of the deceased;

(g) to distribute the assets of the deceased to the beneficiaries;

(h) to provide a final accounts; or

(i) all other things

What should you prepare for your executor?

your will (easily located; maybe in a safebox)

list of assets

list of bank accounts and passwords

usernames and passwords to your email and social media websites

name and contact number of people to contact

your personal documents such as your income tax number, EPF statement, bank statement, birth certificate, marriage certificate and passport

financial and assets documents such as Sale and Purchase Agreement, copy of title, motor vehicle registration license, shares certificate and etc

What if the deceased's property is caveated?

In this case, if the property under the list of assets to be distributed is caveated, the matter becomes a contentious matter, and there is a need to file an application to the court to remove the caveat lodged.

How does a Probate Lawyer charge?

The Charge for a Grant of Probate application ranges from RM3,500 to RM7,500 for the professional fees. If there is any other extra works or the matter is more complicated, there will be extra fees to be charged based on work done.

Paragraph 2(f) of the Sixth Schedule, Solicitors' Remuneration Order 2023 (PUA 207/2023) ["SRO 2023"] states that the professional fees charged by a lawyer shall be based on a fair and reasonable sum after taking in account of:

(a) the importance of the matter to the client;

(b) the skill, labour, specialised knowledge and responsibility involved on the part of the solicitor;

(c) the complexity of the matter, or the difficulty or novelty of the question raised;

(d) the amount or value of money or property involved;

(e) the time expended by the solicitor;

(f) the number and importance of the documents prepared or perused by the solicitor;

(g) the place where and the circumstances under which the services or business or any part of the services or business are rendered or transacted.

For example, if the Court suddenly requires the lawyer to get another High Court to certified true copy of the will, then the lawyer shall charged any additional legal fees for the extra work done.

Subsequently for the transfer of property, there will be another set of legal fees charged on each of the transfer of property based on the SRO 2023.