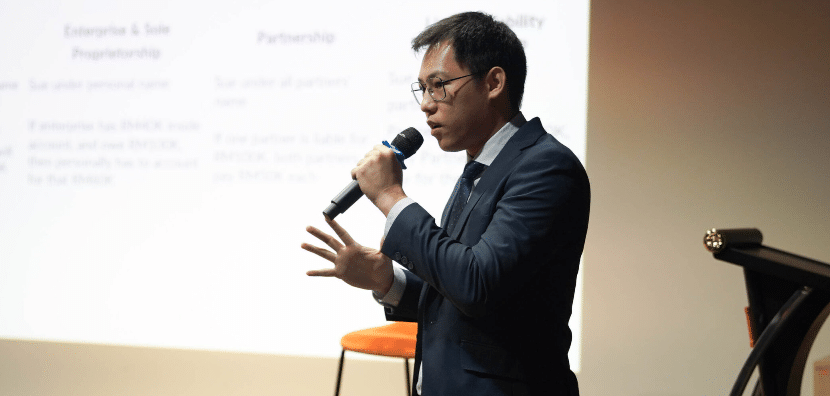

Contact Us for any Speaking Engagement | HRDF Claimable

Our speaker is HRDF accredited, and therefore the professional fees are claimable through HRD Corp. He can gives talks on tailored made Tax, Company and Property Law topics.

Kindly email us at admin@dylanchong.com for the quotation for speaking engagement.

Sale of Property to Foreign Buyers (2024)

On 06.06.2024, Mr. Dylan gave a talk on "Sale of Property to foreigner buyer". among the topics for discussion were on the condition and threshold of selling property selling price in Selangor and Kuala Lumpur, to the need to applying for foreigner consent and the practical issues arised.

Wills & Probate | How it affects property sale/ transfer (2024)

On 04.04.2024, Mr. Dylan was invited again by Reapfield (KW Malaysia) to give a talk on "Wills & Probate". the topic discusses on the application to apply for a Grant of Probate & letters of administration, to the process to apply for transmission, the stamp duty and real property gains tax involved in this process.

What you need to know as an Agent about Strata Title (2024)

On 01.02.2024, Mr. Dylan was invited by Reapfield (KW Malaysia) to give a talk on "What you need to know as an agent about strata title". The topic discusses on the condition precedent on the transfer of title to sale and purchase of property to the tax treatment for the sale of property with consent and low cost property.

How to discharge from a taxpayer from Bankruptcy (2024)

On 21.03.2024, Mr. Dylan was invited by public listed company, Hong Leong Assurance Group to give a talk on "how a taxpayer individual can be discharged from being a bankrupt". Mr. Dylan explained on the procedure to discharge a taxpayer from automatic discharge to application to the Director General.

Main Speaker for "Managing Tax with Compassionate" (2023)

Mr. Dylan was invited as one of the main speaker to talk on the tax issues such as E-invoice, record keeping & tax audits, how to deal with irregularities in tax reporting.

The event was organised on the 13 & 14 June 2023, with esteemed speakers such as Tan Sri Ambrin Buang, the ex Auditor General of Malaysia, former CEO of LHDN, Dato Seri Dr Nizom Sairi, Tan Sri Barry Goh, Dr Nik Abdullah Sami, Tuan Mustafa, Puan Salamatunnajan, Datuk Dr Fam, & Tuan Azizol.

There were around 150 paid participants at the event mainly from private sectors.

Financial & Tax 101 with Financial faiz (2023)

On 31.03.2023, Mr. Dylan was invited as one of the speaker for Mr. Faiz (Financial Faiz), on the session "basic tax planning 101" for individual and corporate tax payer. The topic shared was on "how to file your income tax form" and tax planning for individual.

This event has a recorded paid participants of 200 people who attended.

Untold Secret of LHDN (2022)

On 12 December 2022, Mr. Dylan participated in the untold secret of LHDN, where former director of LHDN was sharing on the topics on tax audit and tax investigations against taxpayer.

Tax Treatment for buying Property; Income Tax vs RPGT (2023)

On July 2023, Mr. Dylan was invited to give a talk for tax treatment for buying a property for property investors by Reapfield Puchong, the event was a closed door event with almost 50 over participants.

Mr. Dylan shared about the badges of trade in determining business income versus capital gains when disposing a property.