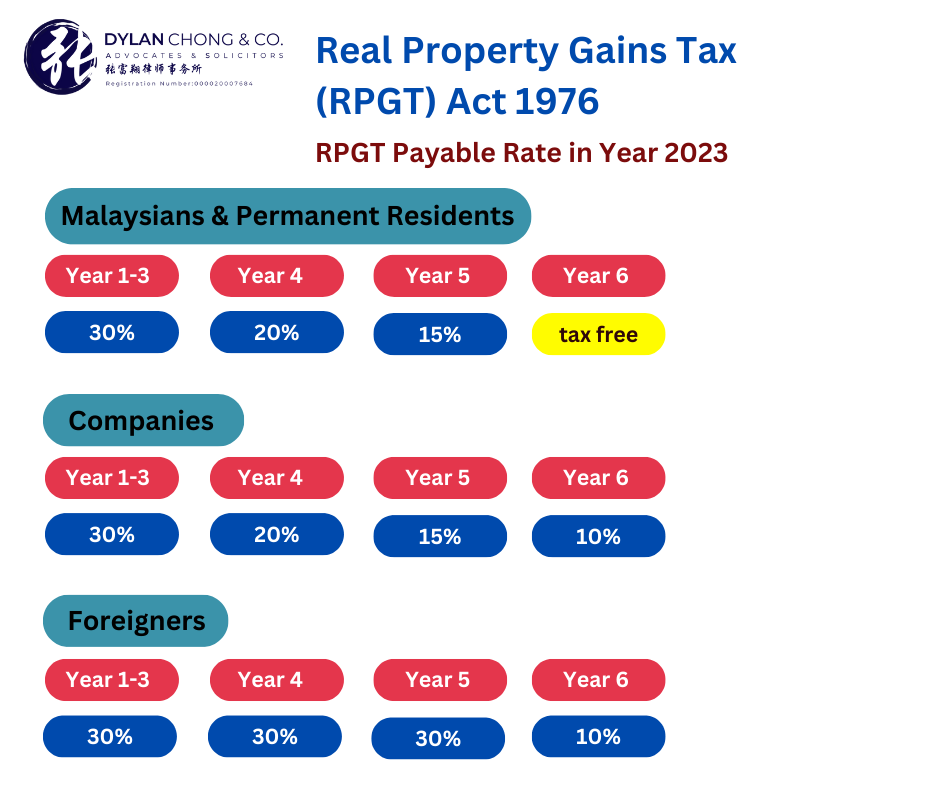

Tax Rate Payable for Real Property Gains Tax

As you can see, individual enjoys the 0% tax after 5 years, while company still has to pay 10%. As for foreigner, irregardless of individual or company, will have to pay 30% tax on the first 5 years, and six year onward a 10% tax.

Individual may be subjected to RPGT as follow:

1st 3 years - 30%

4th year - 20%

5th year - 15%

6th year - 0%

For Local Company (registered under Company Act 2016, with local ownership exceeding 51%)

1st 3 years - 30%

4th year - 20%

5th year - 15%

6th year - 10%

For Foreign Ownership:

1st 5 years - 30%

Next 6 year onward - 10%

Contact us for Tax Planning & Advisory

Foreigner Individual is subjected to RPGT as follow:

1st 5 years - 30% RPGT

Next 6 years - 10 RPGT

[latest update 01.06.2023]

Contact us for tax planning for foreigner buying and selling property

Permanent resident may be subjected to RPGT if they sell their property.

There are tax benefits for Permanent Resident in buying and selling property.

Contact us for advisory on RPGT Law.

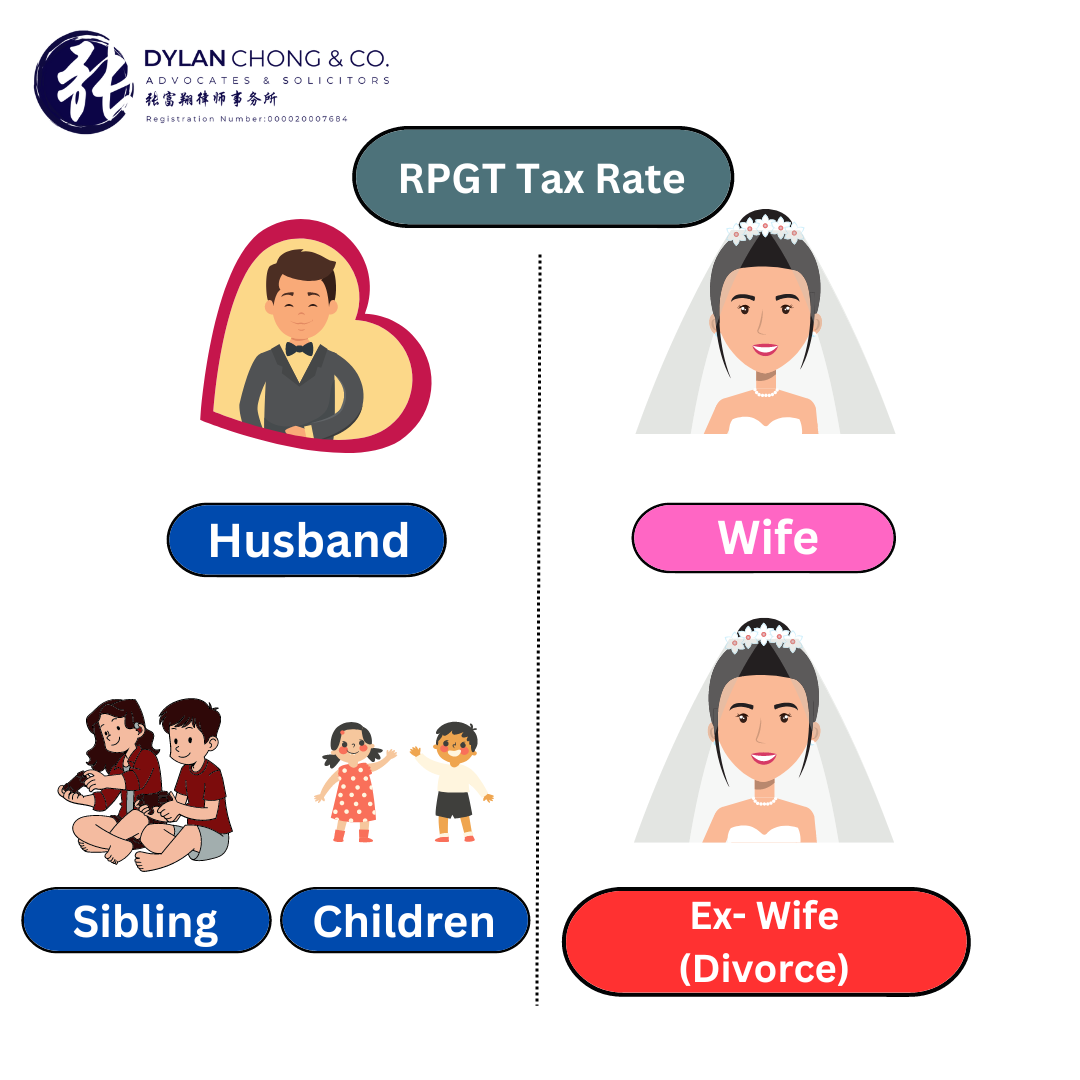

The property sold from husband to wife is usually exempted from RPGT being no loss no gain.

Para 3(b)(i) of Schedule 2 of the RPGT Act 1976.

The Committee will be tax as if the tax is imposed on the Mental health Patient.

see Para 2 of Schedule 1 of the RPGT Act 1976.

Individual or Permanent resident is entitled for once in lifetime RPGT exemption for private residence.

RPGT remission of RM10,000 or 10% whichever is higher.

RPGT based on love and affection applies only on Malaysian Citizen and Permanent Resident.

It should be deemed no gain no loss if transfer by way of love and affection to family member.

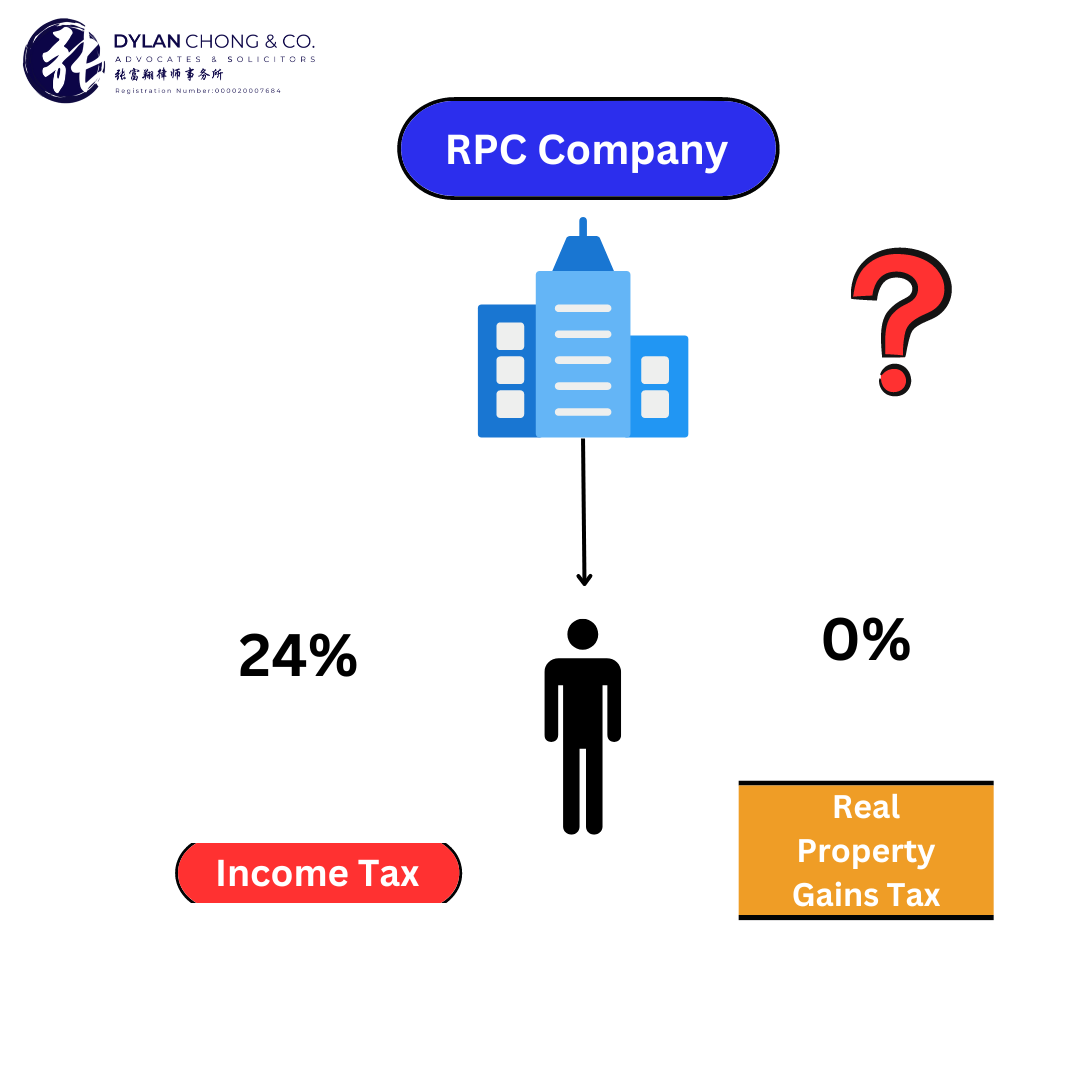

If your property value exceed 75% of the total tangible asset, then it is a Real Property Company that attracts Real Property Gains Tax.

see Para 34A of Schedule 3 of RPGT Act 1976

For Sale and Purchase Agreement with conditional term, the date of acquisition and disposal shall take place upon the approval of the condition.

This applies a lot to sale and purchase agreement where it involves the sale of land subjected to state government approval on low cost, consent to charge, consent to transfer or State EPU approval.

see Para 16 of Schedule 2 of RPGT Act 1976

This process is known as transmission of deceased property to the executor. The Real Property Gains Tax is 0% tax as it is taxed as no gain no loss.

The law governing this is Para 3(1)(a) of Schedule 2 of RPGT Act 1976

Para 4 of Schedule 4.

The sale is subjected to RPGT since it involves sale to a stranger/3rd party.

Section 6 RPGT Act 1976 applies. same with para 1 of Schedule 1 of RPGT Act 1976.

If the Administrator sells back the House to the Wife (newly wed wife), there is RPGT Payable.

see 3(b)(i) of Schedule 2.

The Sale via Order for Sale from Executor to Buyer will attracts Real property Gains Tax.

Contact us for advisory on the disposal and acquisition date.

The Gift from Deceased to a 3rd Party is where the acquisition price of the property shall be deemed to be the market value of the property as at the date of transfer to the recipient. [S2,P.19]

Trustee is chargeable for RPGT under Para 35 of Schedule 2 of the Real Property Gains Tax 1976. It is confirmed via the Case of PTSO v KPHDN.

Introduction

Real Property Gains Tax Act 1976 (RPGTA 1976) was introduced on 07.11.1975 to replace the Land Speculation Tax Act 1974. It is to curb the speculation of property flipping and profiting of sale of property within short span of time. The act of property flipping if not controlled, will contribute to the rise of property price and inflation, as such, the mechanism under RPGTA 1976 was introduced whereby the disposal will be subjected to the RPGT based on years of holding of the property. The principle is that the longer you hold, the lower the RPGT payable.

The RPGT 1976 also recognizes that fact that property investor getting more creative from time to time, whereby they found way to circumvent the RPGT Act 1976 by purchasing property using company. As such, in 21.10.1988, the RPGT Act 1976 had included provision to govern the sale of shares within company and to deem it as real property company (RPC).

Real Property Gains Tax Act 1976 v Income Tax Act 1967

There is always a debate between these two area of law, either one is to be subjected to income tax or capital gain. Check out the Income Tax Act 1967 or article on income tax to know more.

Real Property Gains Tax 1976

RPGT is imposed on the seller, while stamp duty is imposed on the buyer. The seller is known as disposer while the buyer is known as acquirer.

The disposer has a duty to fill up the tax return form known as CKHT 1A, and to fill up the CKHT 3 (election of the applicable RPGT law). The acquirer on the other hand is to fill up the CKHT 2A, to signify him acquiring new asset. The forms have to be submitted to the disposal income tax branch.

Case Study 1: MBL (Administrator of the Estate of deceased) v DGIR (1989)

The fact was in relation to the husband selling off the deceased wife’s property to his newly wed wife for RM90,000. The husband being the administrator had obtained an order for sale for the deceased property in 05.11.1982.

The deceased passed away on 08.01.1980. The husband remarried on 29.11.1980.

The issue was in relation to the sale of the property at RM90,000 from the administrator/husband to the newly wed wife (Melina).

The LHDN had assessed the property to be at the market value of RM121,000. Hence, this is the contention for this matter, whether the market value should be at RM90,000 or RM121,000.

The sale of property was done from an administrator to the newly wed wife, and therefore it is not qualified for exemption from payment of RPGT.

In this case, the husband did not challenge for the market value imposed by LHDN, and therefore the decision of the LHDN stood. It is of the opinion, that the market value of the property as imposed by LHDN should be challenged as market value is different from every single valuer’s report.

Case Study 2: PTSO v KPHDN (1997)

In this case, the taxpayer acted as a trustee for the sale of the deceased property to the Company (Purchaser). The taxpayer was taxed on Real Property Gains Tax (RPGT) for year of assessment 1982. There was a sale and purchase agreement entered into between the taxpayer (as Vendor cum Trustee) and the Purchaser.

The Tax Authority (LHDN) has taxed the taxpayer for RPGT. The taxpayer argued that being trustee they are not liable for RPGT and should be entitled for exemption as the proceed from the sale of the property is not to be given to her, but to the beneficiaries. Plus the date of acquisition should be the date of the agreement. LHDN argued that the date of acquisition should be the date of the ownership of the asset transferred to the taxpayer.

The LHDN applied Para 24(2) of Schedule 2 of the Real Property Gains Tax Act 1976 (RPGT 1976) to this case. The Court agreed with the tax authority's position as para 24(2) of Schedule 2 provides that any payment by way of instalments shall render the later date where transfer of ownership took place to be the date of acquisition.

As such, the Court also applied Para 35 of Schedule 2 to impose the taxpayer being trustee to be taxes with RPGT. In this case, there were many instances where the taxpayer failed to prove the sale of the property was transferred to the beneficiaries with substantial transfer of shares. Evidential wise, the taxpayer cannot prove that it has transfer the property as per the terms of the sale and purchase agreement, and that has led to the downfall of the taxpayer's case.

It is of the opinion that the taxpayer has failed to put in the proper tax clause within its sale and purchase agreement.

Case Study 3 : Hamdan Abdul Hamid (2010)

The Taxpayer wanted to apply for tax relief whereby he had transferred a house bought in year 1970 to his daughter in year 1997. The Taxpayer is a Singaporean Citizen. The taxpayer relied on Para 12 of Schedule 2 of the RPGT 1976 to argue that it is a gift from the donor to donee, no where in the Para 12 of Schedule 2 states that it is applicable to the taxpayer being a foreigner.

The Court disagree and held that the taxpayer being a foreigner, is not eligible for the tax relief. As such the taxing of the provision should be construed in favour of the tax authority as it relates to tax relief sought by the taxpayer, and not a provision in relation to tax liability. The taxpayer was required to pay the RPGT imposed on his disposal of property to his daughter.

Case Study 4: Binastra Holding Sdn Bhd v KPHDN (2003)

The taxpayer company bought a piece of land from Company A and resold to Company B. The tax authority taxed the taxpayer company for RPGT under para 34A of Schedule 2 of the RPGT Act 1976 being a Real Property Company.

The Court had disallowed the RPGT claimed by LHDN on the basis that the taxpayer Company is selling the land as stock in trade, thus should be subjected to income tax and not Real Property Gains Tax. The Court held that the tangible asset was the real property which was the stock in trade, the "gain" which was chargeable to income tax.

In my opinion, it is not a gain, when it has been determined that the source should be taxed at income tax. It is a "profit". Gain refers to a realisation of investment after a holding period. However, this case had went on appeal, however there was no written judgement in the Court of Appeal, thus the decision of the High Court still stands as good law. However, it seems that there was a Court of Appeal Case on Continental Choice Sdn Bhd which had decided a new direction for Real Property Company.

Case Study 5: Kenny Heights Development Sdn Bhd v KPHDN (2005) [COA]

In this case, the taxpayer had entered into a sale and purchase agreement dated 14.08.2000 to sell land to Company A and Company B. The triparty later enter into a supplementary agreement to vary the principal price. Under the new supplementary agreement, there need to fulfil a condition for approval by 27.04.2007. The original consideration had been overruled by the supplementary agreement. The taxpayer appeal had been allowed.