Ongoing Webinars in Collaboration with

Dlearn Academy

Buy and Exit Property Untold LAW Secrets | 26th Nov 2023

One simple property buying strategy can saves you five figures, two strategies can save you up to six figures. If you want to learn to buy property at the lowest cost and exit with the maximum price. Sign up for this Master Class to transform yourselves to become a Advance property Investor. Why choose to become ordinary when you can become the Master?

Income Tax Vs RPGT | 3rd Sept 2023

When you are selling property, you may be exposed either to Income Tax or Real Property Gains Tax (RPGT). This is because the proceed of the sale can be a gain or income. If it is a gain, you will pay RPGT tax based on a reduced scale rate. At your 6th year, you pay 0% RPGT tax rate as an individual seller.

However, if you keep on flipping properties like a trader, you may be subjected to Income Tax! This is because you are engaging in the adventure in the nature of trade. This Webinar is insightful as it will go deep into the analysis why past property buyers ended up paying Income Tax. You will learn the past mistakes these property buyers that have to pay millions in Income Tax and you are able to plan your tax.

How to buy a Subsale House with NO down payment! | Date TBC

Master the Art to buying subsale property without having the need to pay down payment in Our Exclusive Online Event! No more stressing out your partner for forking out a huge lump sum to pay for down payment.

In this course, we will be focusing on buying sub-sale property with No Down Payment: Purpose on why you should do it, Benefits, and Guidelines on how you CAN do it too!

Master Deal closing by dominating the booking form

with Reapfield Properties

The recent seminar on "Master Deal closing by dominating the booking form" for Reapfield property agents was a resounding success. The event, brought together a group of dedicated and motivated real estate professionals eager to enhance their skills and knowledge.

During the seminar, attendees had the opportunity to delve deep into the intricacies of booking forms in real estate transactions. Our expert speakers shared invaluable insights, techniques, and strategies that can make a significant impact on the success of property deals. From understanding hidden motivations to applying psychological triggers, the content was both informative and actionable.

The atmosphere throughout the event was one of enthusiasm and engagement, with attendees actively participating in discussions and Q&A sessions. It was evident that everyone left the seminar with a renewed sense of confidence and a set of powerful tools to excel in their real estate careers.

Overall, the seminar was a rewarding experience for all involved, and it reinforced the commitment of Reapfield property agents to continuous learning and professional growth. We look forward to hosting more events in the future that empower our agents to achieve even greater success in the real estate industry. See you guys next month! 🌝👀

| 27 September 2023

Tax treatment for property buyer and seller

with Reapfield Properties

One fine day, I was preparing my legal files, and I have received a call from Mr Charles Lee from Reapfield Properties. We talked into collaboration and he invited me to give a talk on "Tax treatment for property buyer and seller". On the same day itself, I am glad to meet Mr President of MIEA, Mr Tan Kian Aun, which was also there to give a speech on his past experience.

What an insightful day, glad what I am able to deliver help property agents to grow and upskill their knowledge about property tax, income tax and real properties gain tax, dos and donts when you are audited by LHDN, tips and tricks when and how to sell the property at the right timing so that you or your client pay the least amount of tax.

Once again thanks for the great opportunity, if anyone is interested to learn more about property tax, check out my latest webinar, alternatively you can also nudge me if you are interested to join. My goal is to bridge the gap between people and tax. After all, it is not that complicated! 🌝👀

| 14 August 2023

Managing Tax Compliance with Compassion Conference.

So finally we have ended the 2 full days seminar at everly putrajaya Hotel on the seminar “Managing Tax Compliance with Compassion Conference”.

First, I would like to sincerely thank Prof Datuk Dr Leow and the whole team from Humanology for the opportunity given to me to share the same stage with distinguished speakers such as Tan Sri Ambrin Buang, the ex Auditor General of Malaysia, CEO of LHDN, Datuk Dr Nizom, Tan Sri Barry Goh, Dr Nik Abdullah Sami, Tuan Mustafa, Puan Salamatunnajan, Datuk Dr Fam, & Tuan Azizol.

The topic sharing ranges from e-invoicing, how to do record keeping from lhdn perspective, e-services from lhdn, insight sharing of tax audit and tax investigation, SVDP 2.0, payment issue of e-ckht, e-WHT, e-billing & tax agent/client relationship.

There is a saying you can work for 20 years with 20 years working experience, but it does not mean you will have that 20 years of credibility.

Being one of the youngest speaker to speak on the stage, and to be able to present my speech in front of the Tan Sri(s), Datuk(s) and all the esteemed speakers has given me more courage to give more tax talks in the future.

| 13 & 14 June 2023

Company and Personal Tax in collaboration with Financial Faiz.

In collaboration with financial expert Faiz, I have delivered a series of informative talks on company and personal tax matters. Our sessions aimed to empower individuals and businesses with practical strategies for effective tax planning and compliance. Topics such as optimizing deductions, understanding tax regulations, and minimizing liabilities. By simplifying complex tax concepts and providing real-world examples, we enabled our audience to make informed financial decisions.

We fostered financial literacy and empowered individuals and businesses to optimize their tax positions. By breaking down jargon and offering practical insights, our talks provided attendees with the clarity and understanding needed to achieve a better financial success.

| 31 March 2023

Meeting with Ex-LHDN Officers | Learnt the Untold Secrets of Former LHDN Officer ( December 2022)

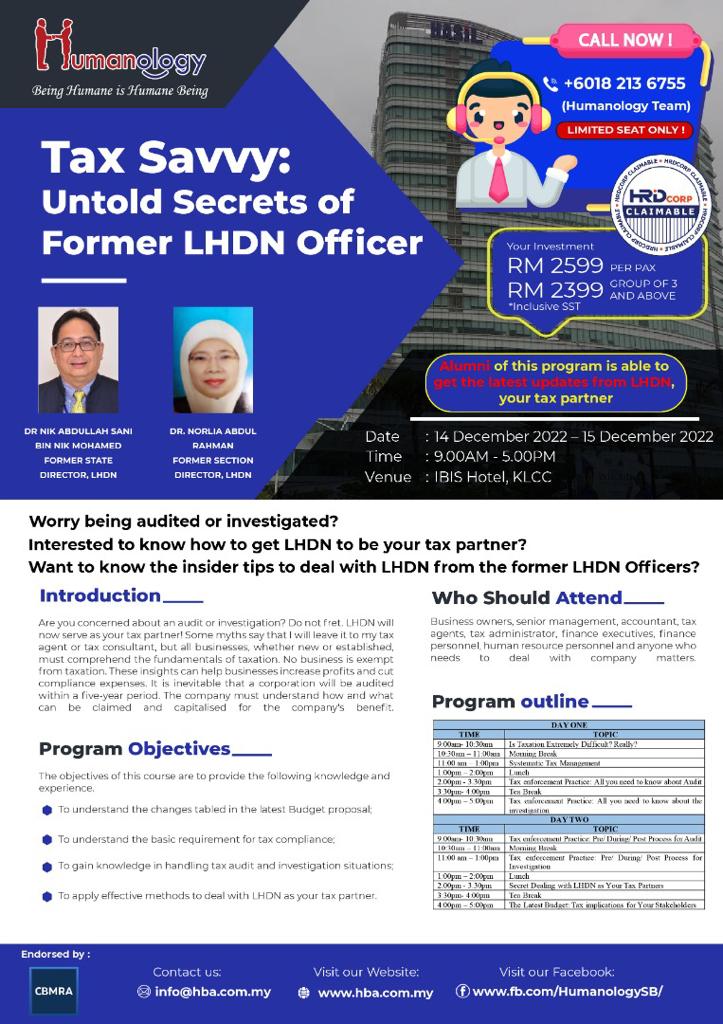

Mr. Dylan has attended to the internal organised meeting by ex LHDN Officer to learn the untold secret and practises with former LHDN Officer such as Dr Nik Abdullah Sani bin Nik Mohamed (former state director for LHDN) and Dr. Norlia Abdul Rahman (former Section Director, LHDN). Among the topics discussed were systematic tax management, tax enforcement practise for tax audit, tax investigation practise (all from the former LHDN director past experiences and the suggested ways to deal with the tax matters.

| 14 & 15 December 2022