Who needs a will?

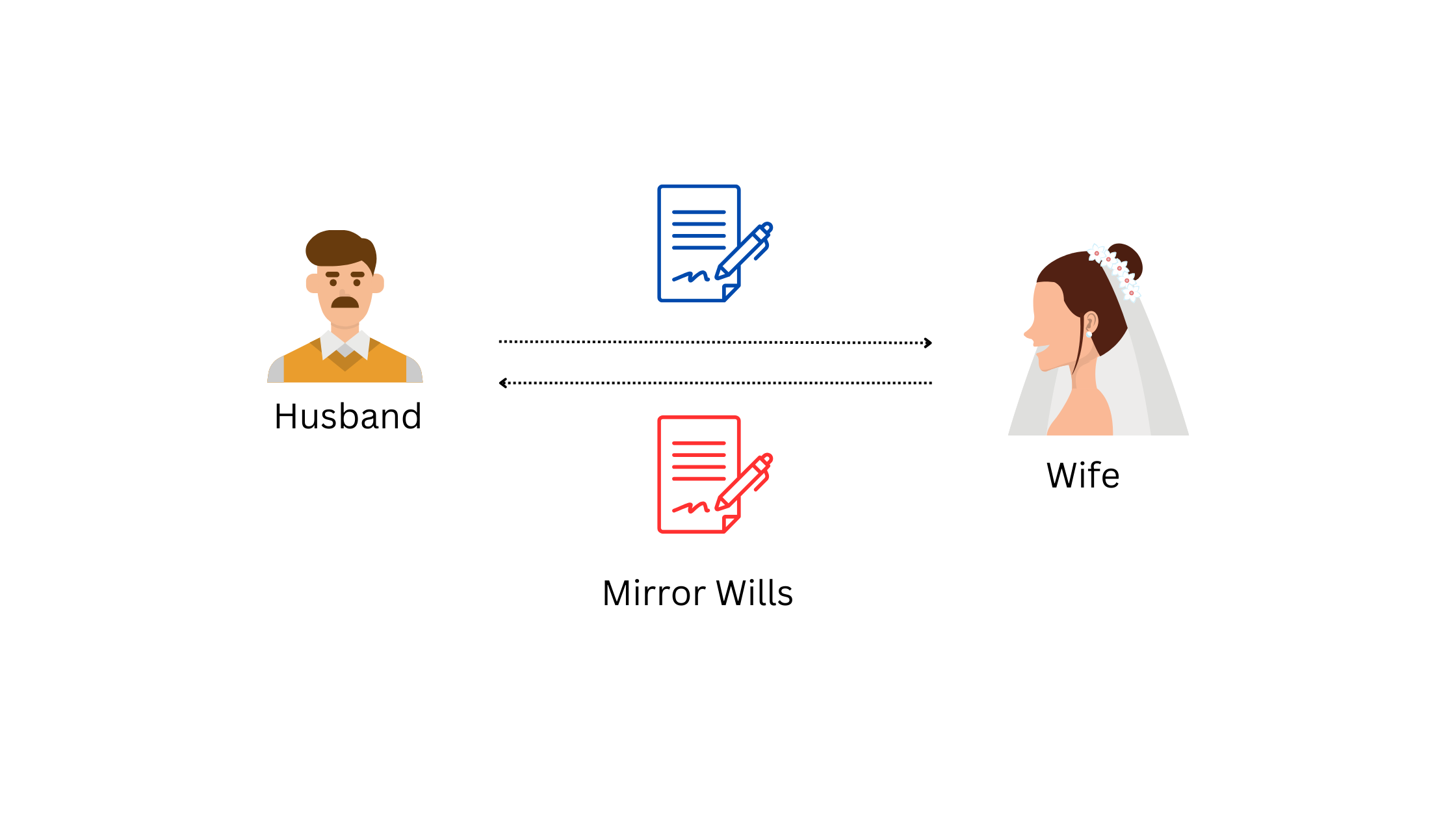

husband & wife - husband will write a will to give all his assets to his wife, and the same goes with the wife. This is call mirror will. When one of them pass away, the other will write a new will to give their assets to their children.

any individual who has owns their 1st property or bank accounts

Why do we need a Will?

Imagine that you only have one more week to live.

What would you write inside your will?

How you would like distribute your asset?

Who should be the one who manage the distribution process of your assets?

Who should take care of your children (minor below age of 18 years old) once you are gone?

Real Life story of a Widower Wife (Ms Kok)

* all names used are a fictitious name and does not represent anybody.

Ms Kok lives in Petaling Jaya, and her husband passed away 10 years ago leaving her a landed house in PJ.

Ms Kok stays with her daughter, Nicole who pays on the monthly housing loan instalment.

Ms Kok has no will, and passed away.

Ms Kok has 2 other children - boy - Bryan and Timothy, and as a result of no will, Ms Kok has to distribute the house to all the children on equal basis.

Bryan and Timothy has a shares in the House because Ms Kok died intestate (with no will).

But the problem comes.

Nicole is the one paying for all the housing loan.

Because Ms Kok does not have a will, all 3 children fight over the leftover PJ landed house.

With a will, Ms Kok could have states clearly in the will, the PJ house is to be given to the daughter because Nicole is the one paying for the housing loan.

And the two other child, Bryan and Timothy may be given cash/monies in compensation of not having a share in the family house.

So think about it for a moment, is having a will solve a lot of problem?

What is a Will?

A will is a legal document that records the last wishes of the death. It is to be used in the Court of Law (the High Court) to apply for a Grant of Probate for purpose to unfreeze bank account, transfer properties at land offices, and as supporting documents to claim for proceed from relevant government bodies (EPF, Income Tax Department, PERKESO), Insurance companies, and etc.

You need a will to:

to plan who to distribute your property to

to specify which beneficiary you would like to exclude

to state who should become the executor to your will?

to name guardian for children below 18 years old

to state your last messages to your beneficiary

What are the basic terms in a Will?

Wills will consist of :

revocation clause - ie, " i hereby revoke all my last wills and testament...." you will see this wording within the will to revoke all your previous will to avoid duplicate or the existence of two wills at the same time. This will create confusion and your beneficiary may challenge it in the Court on validity of the content of the will. It is suggestible to destroy any old wills you have at hand, but putting into a shredding machine, or just torn off the will

executor clause - you may appoint your preferred executor. or you may appoint more than one executor. It is very important to appoint an executor that is willing to carry out the role as an executor. You do not want to appoint an executor who is staying oversea, and could not come back to Malaysia to execute your will when you are gone.

Trusteeship Clause - you can also appoint a trustee to hold property on behalf of your children until they fulfill certain condition. There is one real life example, of a Hong Kong Artist, Lydia Sum, who put into her will, a trusteeship clause, whereby her daughter can only inherit her property or monies if the daughter reaches the age of 35 years old. The mother is so afraid that if her daughter inherit the property at such a young age, she will be cheated off all the inheritance monies.

Guardianship clause - a guardianship clause is a clause that appoints an individual to act as the guardian for the children below 18 years old. It is usually for the care taking of children as children below the age of 18 years old cannot enter into a contract, and cannot own property. So the guardian will hold property for the children below the age of 18 years old, and to transfer the property back to the children once they reach the age of majority of 18 years old upon their birth date.

What makes a Valid Will?

A Will has to be in writing. You cannot record in a voice, and call it a Will. Unlike soldier, they have a privilege to have a "privileged will" or oral will.

What make a will valid is that it must be witnessed by 2 witnesses

If you marry or remarried, please re-write a will, as the previous is automatically revoke under the law. The divorce must be supported by a Court Divorce Order.

You need to sign the will at the foot of the document. If you are not able to sign with an ink pen, you can put a thumbprint and it must be stated clearly that which thumbprint you are using (left or right thumbprint).

You need to be of sound mind. If you are suffering from major Schizophrenia and dementia, then you may not be of sound mind. Any execution of wills in this situation is not valid. You need to apply for a Mental Health Order.

What if I have properties oversea?

It is common for us to have properties in Malaysia or Singapore. You can have few options:

to have a Malaysian Will and Singapore Will. Then to separately apply for a Grant of Probate separately in Malaysian High Court and Singapore High Court; or

use the Malaysian Will which include the Singapore Property and apply for a Grant of Probate in Malaysia. Then re-seal it before the Singapore High Court. This way, you save the legal costs to apply for a new Grant of Probate in the Singapore High Court.

Can I include my EPF savings into my Will?

Will cannot nominate EPF successor or beneficiary.

However, it is advisable to include the EPF detail within the will but it will not revoke your EPF nomination with the EPF Branch.

It is purely practical to include the EPF detail in the will so that the executor or beneficiary can easily locate the EPF detail for filling up EPF withdrawal Form or to inform the EPF Officer on the EPF member deceased.

Imagine if your loved one EPF detail can only be known via the EPF Portal, and the ID and Password is no where to be found.

Rule 7(2) of the EPF Regulations 2001 states, an EPF Nomination will not be revoked by a Will; see [PU(A) 409/2001]