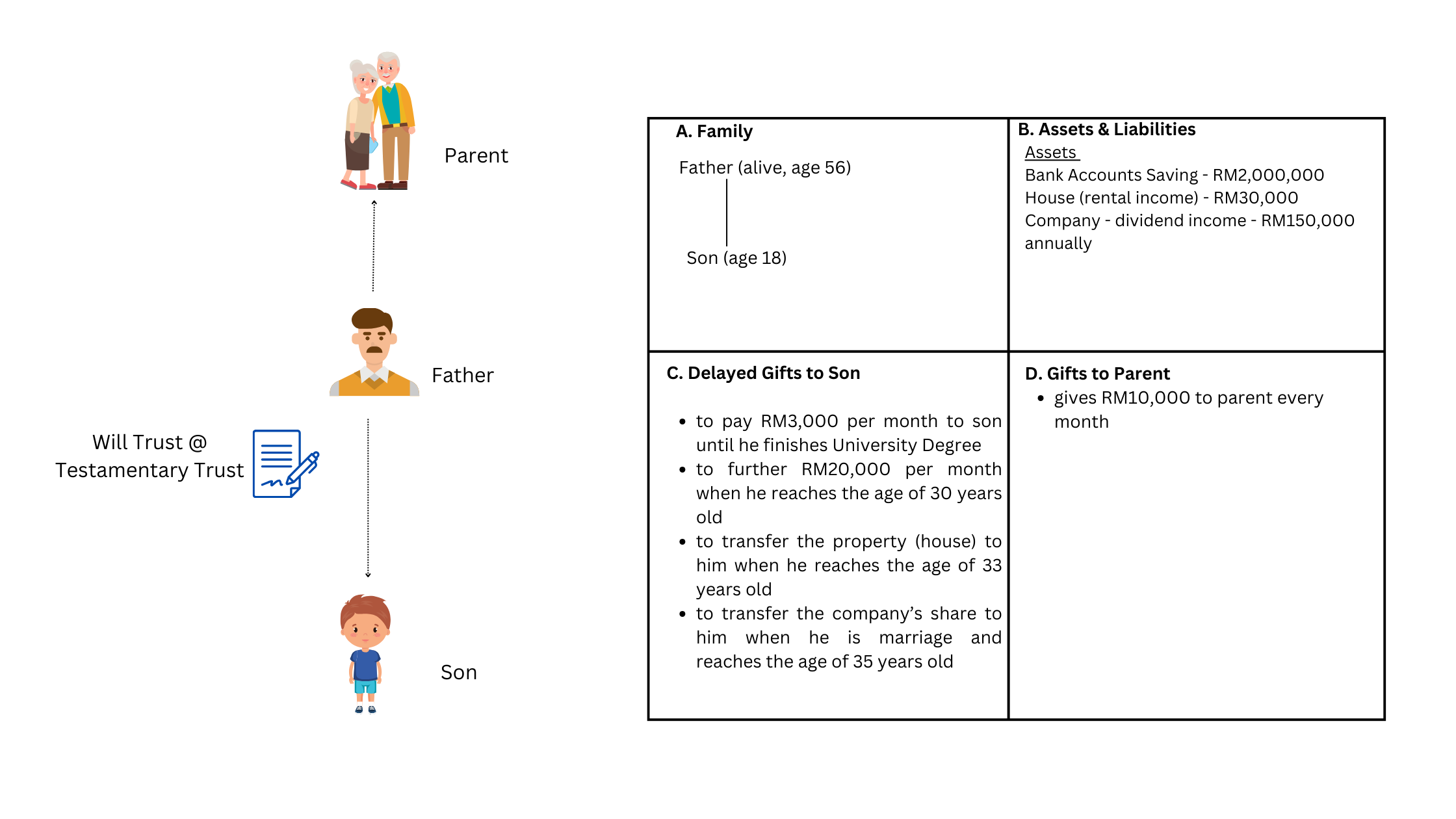

Diagram 1

Who needs a Living Trust?

- any individual

- a company can do testamentary trust to give out dividend income to the shareholders' family member

- father to son, from you to your parents

see the above diagram 1

What is a Will Trust?

A Will trust is the piece of legal document that allows for delayed distribution of your wealth to your beneficiary.

You may have accumulated RM2,000,000 in your lifetime.

You do not want to give it in one lumpsum to your son.

you set criteria for your son to withdraw the monies when he fulfills the criteria that you have set.

see diagram 1 above.

Why need a Will Trust?

A will trust is to cater for beneficiary/children whom are vulnerable to managing a large sum of lump sum inheritance.

Few questions the testator needs to ask:

is my children ready to inherit RM2million from me if i am gone? will they be cheated of the RM2 million lump sum inherited from me?

is my children spendthrift? are they gambler?

do I have elder parent who needs my monies to take care of them?

do I want to allocate a sum of monies as trust fund for my children education?

How do we prepare a Will trust?

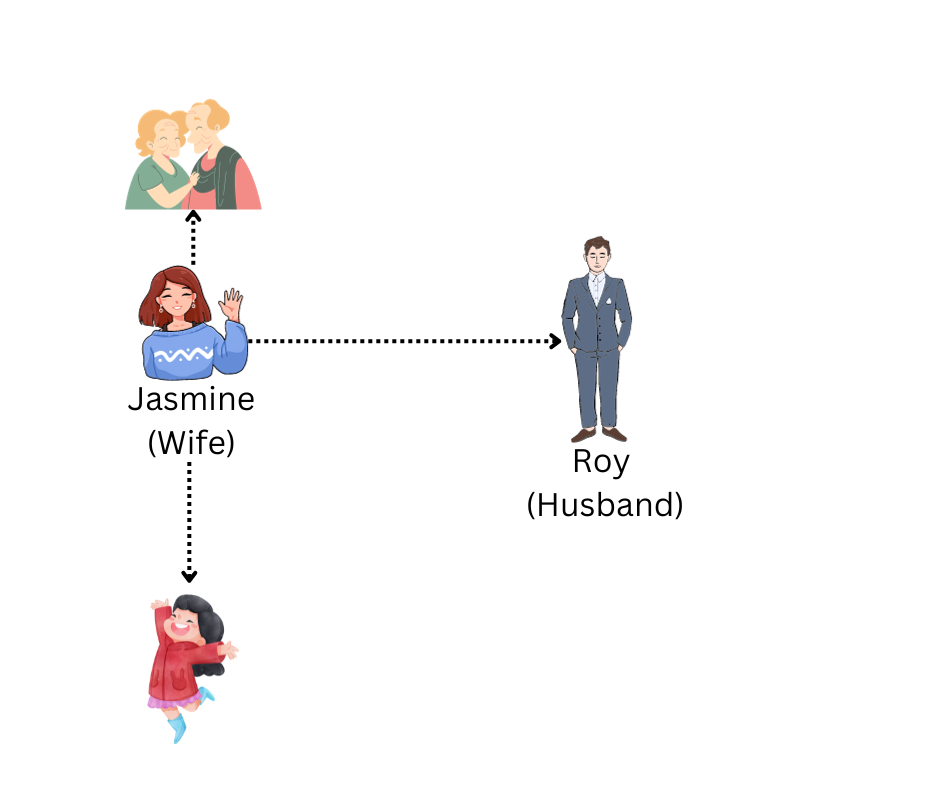

Picture 1

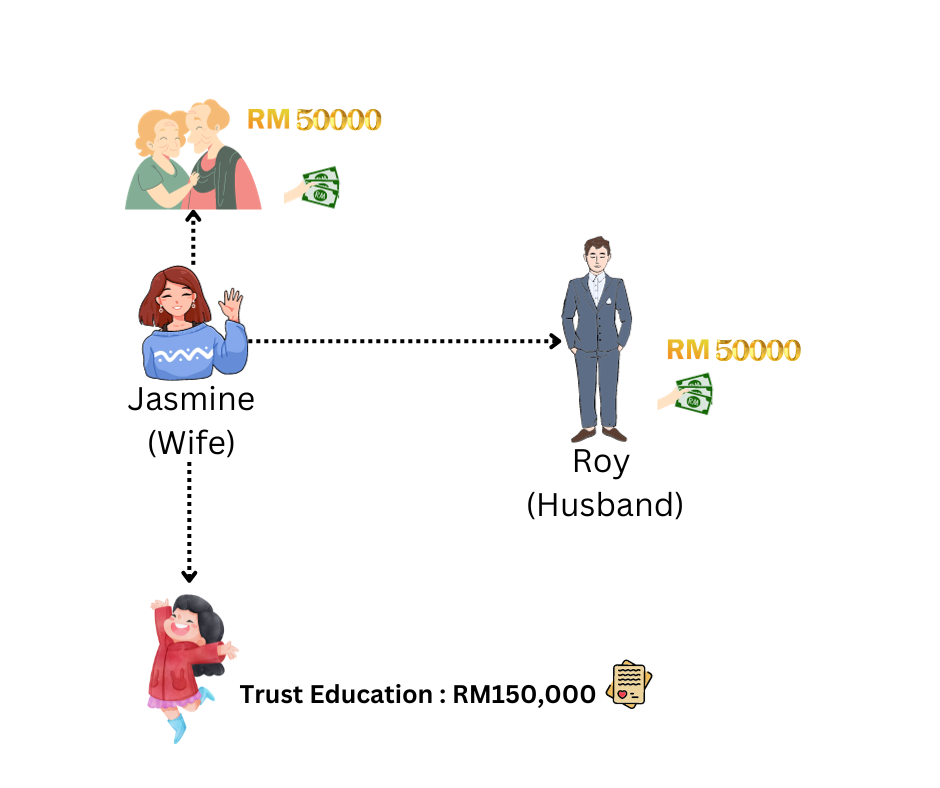

Picture 2

As you can sell above, Picture 1 and Picture 2 above.

Picture 1 shows that Jasmine has a husband (Roy), and parent, and one daughter.

With a Will trust, Jasmine can set a sum of monies as per Picture 2, as a trust money for the purpose of payment of her daughter education.

So, there will be a trustee or trustee company that will hold the trust money of RM150,000 only for the purpose of her daughter education fund.

In the event that Jasmine passed away, her husband can apply for a Grant of Probate with the Will trust with the a clause in the Court Order to state that RM150,000 will be hold on trust for Jasmine's daughter education.

FAQ

The Settlor is the person who establish the trust. The trustee is the person appointed by Settlor to hold the trust on behalf of the beneficiary. The beneficiary is the person who receive the benefit from the trust but they do not own the ownership to the subject matter hold by the trustee.

The trustee is someone you trusted the most. It can be your relative, family members or good friends. The trustee can also be a Trust Company or Law Firm

The cost depends on the complexity of the Will. It will take into account the due diligence, number of trustees, research, discussion and meetings and number of clauses involved in the drafting.

A trustee can also be the same beneficiary.

If you remarried or divorce, you should re-write your trust will as marriage or divorce revokes your Will

You can appoint a trustee to hold property, car, shares, monies, insurance policies, cash, fine art, jewellery and the list is not exhaustive

There needs to be proper planning on trust monies so that the fund does not run out. Otherwise it will defeats the purpose of forming a trust at the first place.